Selling a dental practice is no small task, and if your goal is to sell a dental practice fast and for the right price, you need clarity on valuation, timing, buyer fit, and the transition process (patients + staff).

This guide will help you navigate these challenges, ensuring a smooth, quick sale while maximizing your practice’s value—while also strengthening your online presence with the dental SEO services

so your clinic looks more attractive to buyers and keeps new patient flow strong during the transition.

A Dental Practice Pre-Sale To Do List

Before you sell a dental practice, build a pre-sale checklist that makes due diligence easy for buyers and supports a stronger valuation (think: collections, overhead, hygiene production, active patient count).

Here is a simple to do list for you:

- Organize All Documents: Ensure tax returns, P&L, balance sheet, and a clean add-backs list (owner discretionary earnings) are ready—buyers reviewing a Sell a Dental Practice deal will scrutinize cash flow and EBITDA.

- Simplify Operations: Document SOPs, staffing roles, scheduling systems, and vendor workflows to reduce “operational risk.”

- Update Office Space: Give your office a thorough clean, update the equipment if you can, take care of any repairs.

- Examine Contracts: Make sure all insurance, licenses, and supplier contracts are up to date and in accordance with international standards.

- Patient Retention: Track recall systems, reactivation rates, and new-patient sources to show predictable production.

- Create Marketing Tactics: Collect data on patient demographics, growth patterns, and marketing initiatives. This will ensure that buyers know about the future growth.

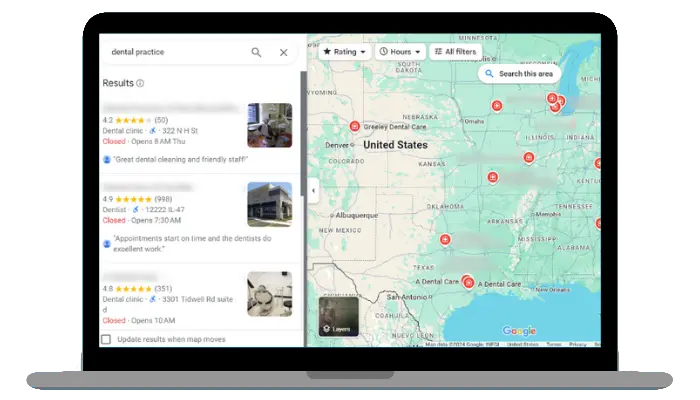

- Optimize Your Website: Invest in the local seo of your dental website. This will ensure that your clinic will rank at the top of the search engine result page (SERP). It will help you in attracting potential buyers.

Maximize Your Online Visibility!

Expand your digital reach and ensure your dental website stands out in search results.

Best Time to Sell Your Dental Practice

The best time to sell a dental practice is when performance is stable (or growing), overhead is controlled, and the local demand for practice acquisition is strong—especially if lending conditions and interest rates support buyers.

Pro Tip: Selling when business is booming or when interest rates are low can often bring more favorable offers.

How to Sell a Dental Practice in 4 Steps

Here’s how to sell a dental practice in four steps while protecting confidentiality, improving valuation, and making the buyer’s due diligence smoother.

Step 1: Plan Early

Start 3–5 years out so you can Sell a Dental Practice with clean financial trends, consistent patient growth, and a transition plan that buyers can trust.

Step 2: Increase the Value of Your Practice

Improve collections, reduce unnecessary overhead, strengthen online reviews, and show durable new-patient flow so you can Sell a Dental Practice at a stronger multiple.

Step 3: Get Your Financial Record in Order

Buyers expect transparency (tax returns, P&L, balance sheet, add-backs, payroll summary). If you want to Sell a Dental Practice without delays, your numbers should tell one consistent story.

| Documents Needed | Description |

| Updated Tax Returns | Proof of financial health |

| Profit & Loss Statements | Shows profitability over time |

| Balance Sheets | Key asset and liability details |

Step 4: Assess Your Practice’s Valuation

Use market comps, asset + goodwill allocation, and income/earnings approaches to price realistically. A proper appraisal helps you Sell a Dental Practice faster and reduces price renegotiation during due diligence.

Here is the detailed overview of each method.

| METHODS | CRITERIA | EXPLANATION |

| Market-Based Valuation | Revenue Multipliers | Compares revenue to similar businesses to estimate value. |

| Recent Sales | Uses recent sales of nearby practices for comparison. | |

| Market Trends | Considers trends in the industry, local economy, and buyer demand. | |

| Asset-Based Valuation | Tangible Assets | Includes equipment, furniture, and other physical assets. |

| Intangible Assets | Considers goodwill, brand reputation, and customer relationships. | |

| Liabilities Deduction | Deducts liabilities, such as outstanding loans or debts, from total assets. | |

| Income-Based Valuation | Projected Cash Flow | Estimates future income based on past financial performance and growth. |

| Discount Rate | Adjusts future income to present-day value based on risk and market conditions. | |

| Growth Potential | Consider the potential for revenue growth and expense control. | |

| Earnings-Based Valuation | Adjusted Net Income | Determines income by adjusting for non-recurring or personal expenses. |

| Capitalization Rate | Uses a rate to convert earnings into present value based on industry standards. | |

| Owner’s Discretionary Earnings | Adds back certain expenses that are not essential to operations. |

5 Key Factors to Consider When Selling Your Dental Practice

1. Patient Base

A loyal patient base adds tremendous value to your practice, signaling stability and growth potential to buyers.

2. Financials

Accurate, up-to-date financial records demonstrate transparency, which builds trust with potential buyers.

3. Staff

Skilled, long-standing staff are an asset. Buyers value a stable team as it ensures smooth operations post-sale.

4. Location

Prime locations add to a practice’s value and appeal. Highly accessible practices are more likely to attract premium offers.

5. Equipment

Modern, well-maintained equipment increases your practice’s value, as buyers avoid additional setup costs.

How to Find the Right Buyer for Your Dental Practice

Identifying Potential Buyers

To sell a dental practice efficiently, target the right buyer type (associate/partner buy-in, solo dentist, DSO affiliation, or investment-backed group) and match them to your practice profile (location, cash flow, specialty mix, growth runway).

- Heartland Dental – One of the largest DSOs, supporting dental offices across the U.S.

- Pacific Dental Services – A major group focusing on comprehensive support for dental practices.

- Aspen Dental – Known for its rapid growth and acquisition of practices nationwide.

- MB2 Dental Solutions – Offers partnerships that retain some ownership for dentists while providing management support.

- Smile Brands – A prominent DSO acquiring practices for expansion.

- Viper Equity Partners – Provides mergers and acquisitions support specifically for dental practices

These companies, along with others like Tusk Partners and Professional Transition Strategies, offer tailored acquisition and transition options for dental practice owners.

Marketing the Sale

Confidentially marketing your practice protects patient confidence.

Options: Use brokers, direct outreach, and digital platforms for effective and discreet promotion.

The Role of a Broker

Brokers offer expertise but come with added costs. They handle the marketing, negotiations, and paperwork to make the process smooth.

5 Essential Questions to Ask Before Hiring Broker

Here are 5 important questions you should ask dental practice broker before hiring him:

- What fees and commissions will apply?

- How long is the contract duration?

- What marketing strategies will you use?

- What experience do you have with dental businesses?

- How will you handle confidentiality?

Creating an Executive Summary for Your Dental Practice Sale

An executive summary provides a snapshot of your practice to interested buyers.

| Section | Details |

| Business Overview | Description of practice history and specialties |

| Financial Health | Summary of revenue, profit, and expenses |

| Growth Potential | Highlights expansion opportunities |

| Competitive Advantage | Unique qualities that set your practice apart |

Negotiating & Drafting the Sales Agreement

Negotiating the Deal

Key negotiation points include price, payment terms, and other contingencies that are necessary for a smooth sale.

Asset Purchase Agreement (APA)

The Asset Purchase Agreement should outline all terms clearly, including non-compete clauses and patient transition plans to avoid future conflicts.

Tax Consequences of Selling a Dental Practice

Selling a dental practice in the U.S. has specific tax implications that can impact the net proceeds. The IRS categorizes sales components, like goodwill, equipment, and real estate, each subject to different tax treatments.

Goodwill is often taxed at capital gains rates, generally lower than ordinary income tax rates, benefiting sellers. However, equipment is usually taxed as ordinary income. Additionally, state and federal capital gains taxes may apply, depending on the practice’s value and location.

Consulting a tax advisor helps structure the sale effectively, optimizing the tax outcome and ensuring compliance with federal and state tax regulations.

Final Steps in the Sale of Your Dental Practice

Closing the Deal

In the final stages, work with professionals to finalize legal and financial matters for a seamless transaction.

Transition After the Sale

Plan a smooth transition for patients and staff, ensuring minimal disruption and maintaining your practice’s reputation.

Common Mistakes to Avoid When Selling a Dental Practice

- Overpricing or Underpricing: Setting a price that is very high or very low can deter buyers or undervalue your hard work.

- Lack of Preparation: Failing to plan in advance can lead to missed opportunities and a lower sale price.

- Incomplete Documentation: Proper documentation is essential to build trust and streamline the sale.

How to Sell a Dental Practice: FAQs

Ready to Sell Your Dental Practice?

Ready to move forward? If you’re planning to sell a dental practice, shortlist platforms/brokers, gather your valuation inputs, and speak with a dental CPA + attorney early to structure the deal, protect confidentiality, and reduce tax surprises.